I know it can be tempting to make quick decisions, especially when you see a hot crypto or stock on the rise, but trust me, patience is key to making smart investments. In fact, MagnifyMoney survey found that 66% of investors have regretted an impulsive or emotionally charged investing decision. Emotions can be a significant factor in investing decisions. By recognizing and managing your emotions, you can avoid making impulsive decisions based on fear or greed. I think you can relate!?????

This approach is a recipe against the dreaded fear of missing out (fomo).

When it comes to investing, you shouldn’t rush it. Doing your research is crucial before making any decisions. Take the time to study the market and the company you’re interested in. Don’t just go with your gut feeling or a hot tip from a friend. I learned this the hard way when I made a swift move and invested in Rain Maker Games at the top of the 2021 bullmarket. I did no research and was lured by the dramatic price upswing. Let me tell you, a crypto bullmarket is sexy and can certainly entice you to invest. Turns out, Rain Maker Games dropped by 99 percent. But I tell myself that I have not lost anything unless I sell the token. I have also bought crypto after drinking wine… Apparently, I am not special even if my mom says so…. 32% of investors have traded while drunk according to a study by MagnifyMoney.

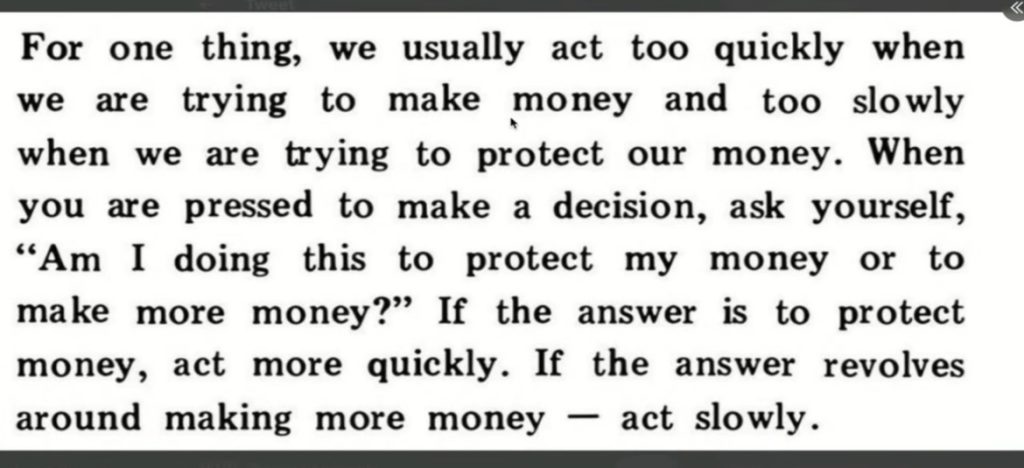

I believe that we need to be slow when investing to reduce the impact of emotions. Avoid investing on a green day. We all get caught up in the hype of a hot asset or panic during a market downturn.

But by taking a more measured approach, we can avoid getting swayed by short-term fluctuations.

It’s like they say, “Invest in the company, not the stock price.”

Now, when it comes to selling, that’s a different story. We can benefit from acting fast! If an investment isn’t performing well, it’s best to cut your losses and move on. Don’t hold onto a sinking ship, hoping it will eventually turn around.

On the other hand, if an investment is doing really well, don’t get greedy. It’s tempting to hold onto it and hope for even more gains, but that’s a risky move. Markets can be unpredictable, and what goes up can quickly come down. So, when I see a significant profit on an investment, I try to sell some of it to lock in those gains. It’s a safer strategy, and it ensures that I don’t lose everything if the market takes a turn for the worse. Profit is profit, regardless of its size.

I have heard multiple times in the crypto space that investing is all about patience, discipline, and a solid strategy. But sticking to a strategy can be difficult. Sure one can buy and hold an asset for years and be a truly successful investor. Not selling is also an action.

However, I remind myself to take my time when investing, do the research, and avoid getting caught up in emotions in an ongoing hype. We need to give ourselves at least a day or two and step out of the hype bubble before deciding what to do. In a 2020 survey conducted by The Harris Poll, 72 percent of American investors said that current events and news influenced their decisions. Obviously, staying up to date is good but always reacting is not.

But, when it’s time to sell, act fast and stick to the plan that you decided on. With this approach, you’ll be on your way to making smart investments.

The problem with this approach is that it’s obvious. In a way it’s too simple. Therefore I fear that I will not be able to take it seriously.

But I believe its valuable to remind ourselves and friends of our tendencies to falter when investing turns emotional.

Do you have an investment strategy or do you wing it?

Please share your knowledge and lessons.