In the heart of Scandinavia, the land with four dramatic seasons, grandma is crying. Sweden has bid farewell to an age-old companion – cash. The evolution towards a cashless society has been swift. Nowadays, cash represents only 1% of the GDP. It’s fair to say, “cash is not king, cash is dead”. The only one that cares is grandma!

As early as 2016, Swedish banks acknowledged that the costs associated with handling physical money far exceeded its benefits. Basically, cash is too expensive.

The decline in the use of cash is vividly reflected in the numbers. The share of cash in Sweden's GDP shows a consistent downward trend, plummeting to a mere 1% of the GDP. This stands in stark contrast to other countries, such as those in the eurozone, where cash still constitutes nearly 10% of the GDP.

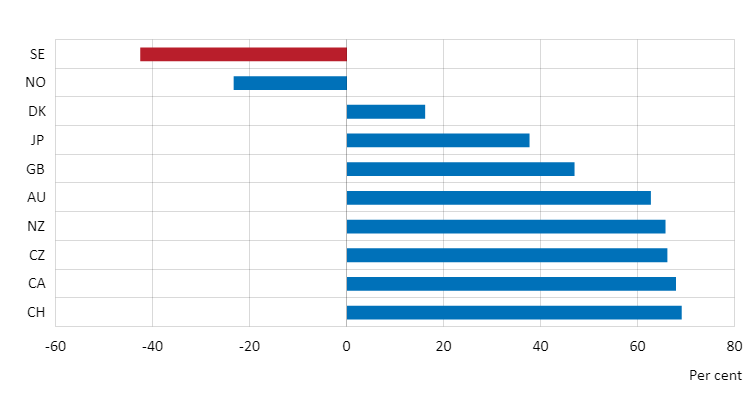

And look at this graph!

Change in the nominal cash volume. Countries with the lowest percentage increase of cash in circulation between 2009 and 2019.

Source: Armelius, H, Claussen, CA and Reslow, A (2020). “Withering cash: Is Sweden ahead of the curve of just special?” Sveriges Riksbank Working Paper Series No 393

The shift in consumer behavior is equally striking. The proportion of Swedes opting for cash transactions dwindled from 39% in 2010 to a mere 9% in 2020. This drastic reduction over the past decade underscores a significant change in the way Swedes perceive and utilize money.

However, despite the clear trend towards a cashless society, the Swedish government has not declared any intention to cease the production of notes and coins. For example, nations need cash to support the needs of the people in crises where the electrical grid goes down. Or for grandma to pay for groceries. Overall, it seems the farewell to cash is more a consequence of market forces and changing consumer preferences than a deliberate policy decision. Yet, the Swedish government has set digital goals for 2030, and is aiming to be at the forefront of digitalization.

Sweden has entered the realm of digital currencies with the e-krona pilot project. In its second phase in February 2021, the project explored the technical and legal aspects of a digital currency. Although no final decisions have been made, the project's progression indicates a potential future where digital currencies could replace physical cash. I would like to underline the stark reality that the expenses incurred in dealing with coins and notes vastly outweigh their utility.

Money, throughout history, has always adapted to the needs of society. Shifting from shells to metal coins, paper notes, and now digital numbers. As we look at what’s going on with money, we need to understand the roles money plays:

1. help us compare prices,

2. preserve its value over time,

3. be universally accepted.

The ongoing change in the financial landscape is merely a part of the transformation of society. We might fear change and hold tight to what has worked before, but the leather wallet is worn-out, and I can hardly remember what cash looks like anymore. Money will live in phones, watches, and in places we have not yet imagined. Cash is dead!

It’s obvious. In a digital world, digital money created by the government and cryptocurrencies operating on decentralized networks and free from government control are essential alternatives to cash. Certain cryptocurrencies may be seen as modern cash.

Sorry, grandma, the march toward a digital monetary landscape is not just a trend; it is the next chapter in the ongoing story of money's evolution.